A non-exempt employee must be paid for all hours “suffered or permitted to work.” If the employer receives the benefit of the employee working, the employer needs to pay for it. According to the Department of Labor (DOL), non-exempt employees need to be compensated between the time when an employee “commences his/her ‘principal activity’ and the time on that day at which he/she ceases such principal activity or activities.” The workday may therefore be longer than the employee’s scheduled shift, hours, or production line time.

Employers need not pay non-exempt employees for any time they are not actually working when clocking in early (i.e. talking with co-workers, reading a newspaper, sitting in the break area, drinking coffee, etc).

Time clocks are not required but are still used in certain industries.

Rounding Rules

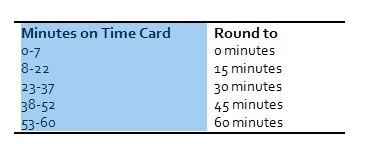

The Fair Labor Standards Act (FLSA) indicates that the practice of “rounding” or adjusting time clock punch times is allowed as long as it works to the advantage, not the disadvantage, of the employee. Since paying to the exact time is preferred, a time system that can record and track time to the exact minute should be utilized. If a time system cannot record to the exact minute, then it is permissible for the employer to round up or down in increments of up to a quarter hour, as long as the clock rounds both ways. For example, if an employer rounds to the nearest quarter hour, then a start time of 7:53 is rounded to 8:00. Similarly, an employee clocking out at 4:53 would be treated as working until 5:00.

A fifteen minute rounding practice could look like this:

When Employees Fail to Clock In

Employees’ failure to clock in and out can become an issue for employers. This should be addressed through an organization’s disciplinary process. Employees need to understand the expectations and the importance of accurate timekeeping.

The bottom line is that the FLSA requires employees to be paid for all hours worked, whether they punched/clocked in or not. The DOL, which enforces the FLSA, considers the failure to clock in to be an administrative and disciplinary problem the employer must solve by being vigilant and enforcing its disciplinary procedures. You cannot refuse to pay an employee for failing to clock in or out, nor can you deduct pay as a penalty for failing to clock in.

Have wage and hour questions? MRA’s HR Hotline Advisors can help you!